May 2024: Optimize P&L and Cashflow with Power BI

Master Power BI Cash Flow & P&L Statements - May 2024 Comprehensive Guide

Key insights

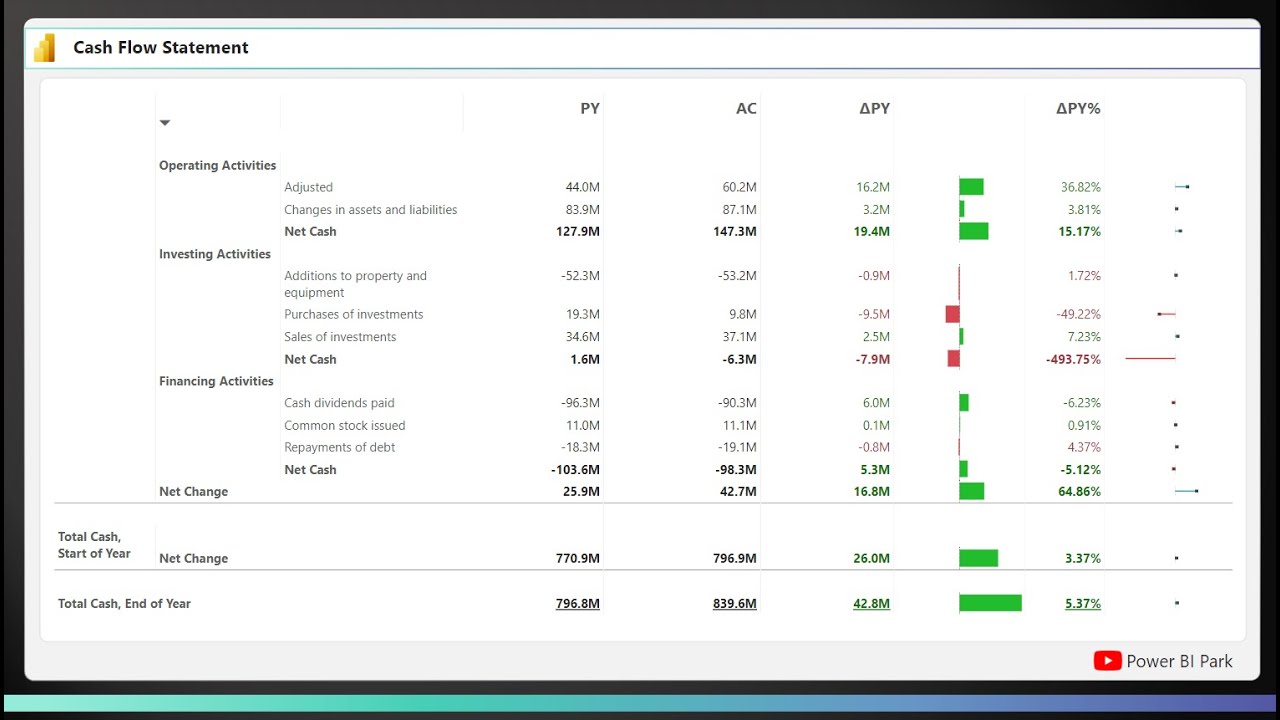

- Learn to create a detailed Cash Flow (CFS) and Profit & Loss (P&L) Statement in Power BI by connecting to financial data, modeling this data, and designing informative reports.

- Begin by connecting Power BI to various sources like Excel files, databases such as SQL Server or Oracle, or cloud-based systems. Then model your financial data effectively by establishing relations among tables.

- Develop essential DAX measures like total revenue, net income, and detailed calculations for cash flows from different business activities, ensuring you have comprehensive data analysis tools at your disposal.

- Design your Power BI reports using compelling visuals such as matrix displays, bar charts, waterfall charts, and include elements like slicers and filters to make the data more accessible.

- Enhance your reports by investigating Power BI templates, adding custom visuals, and ensuring consistent formatting and regular data refreshes for accurate reporting.

Understanding Power BI for Financial Reporting:

Creating financial reports using Power BI, specifically Cash Flow and Profit & Loss statements, involves a thorough process from data connection, data preparation to report design and analysis. By leveraging Power BI’s integration features, financial professionals can connect to diverse data sources such as Excel, SQL Server, and various cloud-based accounting software platforms.

Effective data modeling is crucial. Relationships among different financial tables allow for the preparation of dynamic and interconnected reports. These reports not only highlight financial standings through standard P&L statements but also provide deep dive views into cash flows and balance sheets, showing the movement of cash through various company activities.

Through DAX (Data Analysis Expressions), various measures and calculations can be configured to cater to specific financial reporting needs. Measures such as total revenue, net income, and cash flow calculations enable businesses to track financial performance with precision. DAX adds a layer of advanced analytics to simple data models by allowing custom calculations and aggregations.

The visualization capabilities of Power BI also play a critical role in financial reporting. By using different visual components, financial data can be presented in a digestible and visually appealing format. Features like matrix visuals for statement layouts, bar charts for trends, and KPI cards for key metrics make data interpretation straightforward for stakeholders.

Finally, customization and regular updates are important. Financial reports should not only be accurate and insightful but also visually aligned with company branding. Regular data updates ensure that reports reflect the most current data, aiding in making timely financial decisions. Power BI’s capacity to utilize templates and custom visuals further enhances the presentation of financial data, making it an indispensable tool for financial analysis and reporting.

Cashflow and Profit & Loss Statement creation in Power BI was the focus of a recent tutorial by Injae Park. Published in May 2024, the tutorial emphasizes the importance of integrating financial data to produce comprehensive financial reports.

Step one starts with connecting Power BI to a financial data source. Popular sources include Excel files, databases such as SQL Server, Oracle, and cloud-based accounting software. A thorough data modeling is crucial, allowing for the effective organization of financial data into various categories like revenues, expenses, and cash flow transactions.

After setting up the data connections, establishing relationships between the various tables is the next step. This includes linking profit and loss accounts to a chart of accounts table, and likewise for balance sheet and cash flow transactions. This ensures fluidity and consistency in the reporting process.

- Data Connection and Data Preparation

- Calculations and Measures with DAX

- Report Design and Visuals

Calculations and DAX formulas are essential components. Creating DAX measures for each line item in financial statements facilitates the calculation of totals, subtotals, and various financial ratios. These measures help assess business performance over different periods.

For example, generating measures for total revenue, cost of goods sold, gross profit, and net income is explained. It also includes formulas to calculate cash flows from different business activities. Using both the direct and indirect methods provides a comprehensive understanding of cash movements.

Reporting accuracy and clarity are vital. Using matrix visuals for displaying financial statements and incorporating charts like bar and line charts can help visualize trends. KPIs and cards are suggested to highlight critical financial figures such as net income and cash balances.

The finishing touches to a comprehensive financial report involve the thoughtful use of slicers and filters. This allows users to customize views based on time periods or other relevant dimensions, enhancing the interactivity and functionality of the financial reports in Power BI.

In addition to the core components of creating a financial report, Injae Park also discusses additional resources and tools. Using templates tailored for financial reports and considering custom visuals can elevate the professional appearance and usability of the reports. Consistent formatting across reports and setting up regular data refresh schedules are also emphasized for maintaining accuracy and relevance in reporting.

Furthermore, Park's tutorial does not just limit itself to guidelines; it also provides practical DAX examples. Demonstrative formulas for calculating total revenue, net income, and cash flow from operations are illustrated, assisting learners in understanding the application of DAX in real-world scenarios.

For anyone looking for more in-depth guidance or specific answers to calculation-related queries, Park encourages reaching out. This responsive approach makes the tutorial not just a learning tool but a platform for interactive learning and support.

Understanding Cash Flow and P&L Statements in Power BI

Power BI proves to be an essential tool for finance professionals seeking to enhance their reporting capabilities. Particularly, cash flow and P&L statements are crucial for capturing a complete picture of a company's financial health.

By leveraging the capabilities of Power BI, users can integrate raw data from diverse sources into an intelligible format. This transition not only aids in continuous financial monitoring but also in strategic decision-making based on robust data-driven insights.

Tools like DAX formulas allow for detailed financial analysis, making it simpler to break down complex financial data into understandable metrics. These capabilities facilitate not just current financial analysis but also predictive assessments, helping businesses plan better for the future.

Overall, learning to efficiently create and manipulate cash flow and P&L statements in Power BI can significantly benefit business management. It empowers businesses with the ability to understand detailed financial nuances and adapt to changing financial circumstances effectively.

Learn more about Power BI

People also ask

## Questions and Answers about Microsoft 365"What is the P cash flow formula?"

Answer: The formula for calculating the Price to Cash Flow Ratio (P/CF) involves dividing the market capitalization by the operating cash flows of the company. Alternatively, one can also calculate it on a per-share basis where the latest closing share price is divided by the operating cash flow per share."What is a good P cash flow ratio?"

Answer: Generally, a price-to-cash-flow ratio below 10 is considered favorable. Lower ratios indicate that a stock may be undervalued relative to its cash flows, suggesting a potentially attractive investment opportunity."What does p-FCF mean?"

Answer: The Price to Free Cash Flow Ratio (P/FCF) is a financial metric assessing a company's valuation relative to its Free Cash Flow. It is calculated by dividing the company's share price by its Free Cash Flow per share."What is P to free cash flow ratio?"

Answer: The price-to-free cash flow (P/FCF) ratio is a valuation metric that compares a company's market value with its operating cash flow, or compares the stock price per share with its operating cash flow per share. This ratio is particularly useful for analyzing companies that have substantial non-cash expenses, such as depreciation.Keywords

Cashflow P&L Statement Power BI May 2024 Update financial reporting business intelligence data visualization Power BI tutorials